The Government of India has come up with various schemes for the benefit and employment of the citizens of the country. And this time the government of India has come up with a bond market scheme. And this Bonds market scheme started by India has been started by RBI. The scheme launched by the Prime Minister of India Narendra Modi is called RBI Retail Direct Scheme. The direct retail scheme will be managed by RBI itself. Through this scheme, every citizen of the country will be able to make direct investments from now on. Today we will provide you with all the information about RBI Retail Direct Scheme Invest Government Securities through this page.

This scheme has been started by the Government of India and RBI. Through this scheme, all citizens of the country will be able to invest directly in government securities. Today we will provide you all the information about the purpose of the scheme, benefits, required documents, direct investment risk, and how you will make RBI retail direct investment, etc. If you would like to know more about RBI Retail Direct Invest Scheme, we suggest you read this page in its entirety.

Read it also- दिल्ली श्रमिक मित्र योजना

Brief project description

| Name of scheme | RBI Retail Direct |

| Objective | Opportunity for individual investors to invest directly in government securities. |

| Beneficiary | All citizens of the country will be able to take advantage of the retail direct scheme. |

| Launched by | Government of India |

RBI Retail Direct Invest About

The RBI Retail Direct Scheme will be operated by the Government of India and the RBI. This Retail Direct Scheme is the only solution in India through which all independent investors in India can avail the benefits of investing in government securities. Through this portal, all citizens will be able to buy and sell government securities bonds directly. Since you can invest directly in Bonds Market through this portal, you do not have to pay any commission. And you can say this portal is almost risk-free. Since this portal will be controlled by RBI, its security here is close to 100%. All investors can create Gilt Securities Account in Retail Direct Scheme.

Read it also- Employment Exchange Registration

RBI Retail Direct Scheme 2022 Highlights Key

| Name of scheme | RBI Retail Direct |

| Launched by | Government of India |

| Under the scheme | Under the Government of India |

| Department | RBI (Reserve Bank of India) |

| Country name | India |

| Beneficiary | This portal will provide benefits to the citizens of the country. |

| Objective | Opportunity for individual investors to invest directly in government securities. |

| Year | 2022 |

| Post category | Scheme |

| Support | 1800 267 7955 |

| Official Website | https://www.rbiretaildirect.org.in/index.html |

Read it also- E Shram Portal: Shramik Card Registration, CSC Login

RBI Retail Direct Scheme

The Government of India has introduced Direct Investment Scheme in Government Security for all citizens of the State. This time all the citizens of the country will be able to invest in the government bond market through RBI Retail Direct invest. The entire investment process will be handled by the RBI. And since it is being managed by a government agency, it is believed that there is a risk factor of around 0% in this investment. And since you can invest directly here without any means, you will not need any commission.

We get a variety of options to invest in public bonds and the stock market, but when it comes to investing in government bonds, we have to invest indirectly through insurance companies and mutual funds. But now the Direct Retail Investment Scheme has been launched by the Government of India and the RBI. You can invest in government securities directly without any broker through RBI direct investment. We will provide you with all the details about Arabic Idite Retail Investment through this page, so please read the whole post carefully and carefully.

RBI retail direct invest Government security

This retail direct investment operated by RBI allows you to invest in government securities. And all the government security bonds on which you can make direct investments are –

- RBI Bonds

- Central Government Bonds

- State Government Bonds

- Treasury Bills

- Sovereign Gold Bonds

You can also invest in such bonds of government securities that have less than one year maturity period through this portal of RBI. And through this portal, you can invest in the primary market. This portal is secured by the Government of India and RBI, so we can say this product is almost 100% secure compared to other brokers because here the government promises you a guaranteed settlement.

RBI retail direct investment objective

We will give you some information about the purpose of this Retail Direct Investment launched by the Government of India –

The main objective of RBI retail direct investment is to enable all citizens to make direct investments in government securities. There are many more purposes that we will tell you about on this page. The government wants to expand the bond market in India through RBI retail investment. Through this scheme, the government will be able to collect funds for various government projects from the citizens of India. Now all of you can invest directly in government jobs through this RBI portal. Citizens who want to start this portal investment must first register under this portal.

You will also be able to trade both primary and secondary through this portal. Just as you can trade in a new IPO in the stock market, so you can invest in new government security in the Bonds market. Since it is being run by a government agency, the risk factor here will be around 0%. You can create an account through rbiretaildirect.org.in and invest in Government Security.

RBI retail direct investment risk factor

There are generally three types of risks in this scheme, and we discuss those risks below –

- Default Risk: We have already informed you that this portal is run entirely by the Government of India and r.b.i. Being managed by. All the processes of this portal will be regulated by RBI, so the security risk of investment here is around 0% because here the government guarantees a guaranteed settlement.

- Market Risk: Market Risk means that your interest rate on investment fluctuates. But if you wait until your bonds mature, then your interest rate will not be a risk. Because in that case RBI. Or the Bonds Authority will give you full interest of maturity. But if you withdraw money before maturity, you will have a slight risk of interest rate.

- Liquidity Risk: Since this portal has just launched, there may be Liquidity Risk. Suppose you buy a bond but when you sell it will not have buyers. But even here, if we hold on to maturity, there will be no risk.

You can also buy Bonds according to your goals. Suppose you buy a car or a house after 5 years or 10 years, then you can buy bonds for a fixed period of 5 years or 10 years. You will get good interest in it. And in this way, you will not have Market Risk and Liquidity Risk.

RBI Retail Direct Scheme Eligibility Criteria

The Eligibility Criteria for Retail Direct Investment are –

- You must be a citizen of India.

- You have to have any one document to do KYC.

- Applicants need to have a bank account.

Govt securities retail direct investment document

The documents required to apply for this scheme are –

- Aadhar card

- Any one of the documents of application for KYC.

- Valid email id

- Mobile number

- Bank account details

Speaking at the launch of two customer centric initiatives of RBI. https://t.co/Xt4HGfz1Ut

— Narendra Modi (@narendramodi) November 12, 2021

RBI retail direct investment benefit

On this page, we will tell you about RBI Retail Direct Investment Benefit –

- The government of India has started RBI retail direct investment. And this product is managed entirely by RBI.

- The scheme was launched on 12 November 2021 by Prime Minister Narendra Modi.

- The biggest benefit of RBI retail direct investment is that there is no intermediary. You can invest directly in Government Security Bonds here.

- And since you will make a direct investment, there is no commission here.

- RBI retail direct investment gives almost 100% security because here the government promises you a guaranteed settlement. We think any other type of company will give more security than the government.

- We can call Indian retail direct investment portal almost risk-free.

- There will be both primary and secondary transactions through this portal. This means you can buy and sell like the stock market through this portal.

- RBI retail direct investment portal will be anonymous transaction. Here we do not know who are the buyers and who are the sellers.

- And we will have more faith in this portal.

- All transactions will be done online through the Indian direct retail investment portal. So you don’t have to go to any government office to buy bonds.

All these benefits will be for the detailed investors. But let us know what will be the benefit of this RBI retail direct investment scheme of the Government of India.

Read it also- Covishield Vaccination Certificate Download

Indian Govt retail direct investment scheme benefit

Below are some of the benefits that the Government of India will get through this Direct Retail Invest –

- Government of India has started RBI retail direct scheme.

- This is a very good approach of the Government of India for Bonds Market Expansion in India.

- Through this scheme India’s Bonds Market can be developed very well.

- Liquidity will increase through this scheme. Liquidity will increase when more citizens transact here. This means that if you ever sell Bonds before they reach maturity, you will easily find buyers.

- The government will also receive large-scale funding to execute various infrastructure projects.

- And our India year will gradually develop infrastructure and Bonds Market with the help of this method.

All of these points are the benefits of knowing how to open an Indian Retail Direct account.

How to register RBI retail direct?

Citizens of India who want to register under the RBI retail direct investment portal should follow the procedure given below –

- To open a Retail Direct account, you must first access the official website of the authority.

- After entering the official website, you will see the option of opening an RBI retail direct account on the homepage. You have to click on that option.

- After clicking on the option a new page will open in front of you where you will see the registration form.

- You will need to fill in all the information requested in the registration form. Such as – account type, full name, PAN no., Email ID, mobile number, date of birth, login name. (If you select the account type ‘Joint Account’ then you have to fill in the second holder details in the same way).

- You must tick the box below after carefully filling in all the information correctly. And then you have to click on Preview and Submit option.

- The next step is to verify your application form. Your account will be created after verification is successful.

- And this way you can create RBI Retail Direct account.

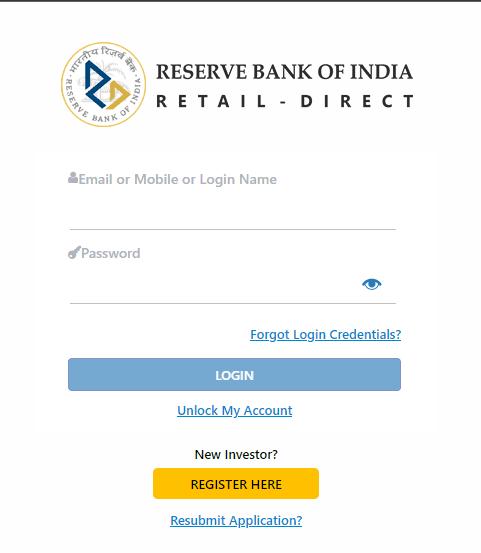

RBI retail direct account login

To login to the Indian Retail Direct account, you need to follow the steps given below –

- To login you first need to enter the official website of the authority.

- After entering the official website of the authority you will see the option to login to the homepage. You then need to select the login type.

- After selecting the login type, a new page will open in front of you. And on that page, you have to enter your registered email id / mobile number/login name.

- After completing all the information correctly you need to click on the login option.

- And this way you can login under RBI retail direct.

RBI retail direct helpline

We have provided you with almost all the information about RBI Retail Direct Scheme. If you still have any problems with this portal, you can contact the authority’s customer service. RBI retail direct toll-free number and email id we gave below –

- Toll Free No.: 1800 267 7955

- Email ID: support@rbiretaildirect.org.in

Conclusion

We hope you have found almost all the information about RBI retail direct scheme. If you still have questions related to this page, you can ask through our comment box, we will answer your question as soon as possible. And don’t forget to let us know how you like this post. Thank you so much for spending your valuable time with us. Jai Hind, Vande Mataram.

RBI Retail Direct Scheme FAQ

On Friday 12th November 2021, Prime Minister Narendra Modi launched RBI retail direct scheme. This is the only way for all citizens of India to invest directly in government security. And all investors can open retail direct Gilt Securities Account. You do not have to pay any commission to invest directly through this portal.

The official website of RBI Retail direct scheme is rbiretaildirect.org.in. You will get all the information about RBI retail direct investment through this official website.

Since you can invest directly in government securities through RBI Retail Direct Scheme, and there is no intermediary here, you do not have to pay any trading commission. RBI detail direct trading commission is 0 (zero).

The RBI Retail Direct Scheme was launched on Friday 12th November 2021 by Prime Minister Narendra Modi. The scheme will be fully managed by RBI.

To apply for the Retail Direct Scheme, you first need to go to the official website of the Authority and click on the Open RBI Retail Direct Account option. Then you have to give all your details in the registration form.